In financial markets, stock indices often serve as a shorthand for economic confidence. They capture how investors perceive the strength, resilience, and prospects of an economy in a single, constantly moving figure. In Switzerland, this role is played by the Swiss Market Index, commonly known as the SMI. More than a benchmark for traders, the SMI offers meaningful insight into the structure of the Swiss economy and the forces that shape its performance on the global stage.

Understanding how the index works and what it represents helps explain why Switzerland is frequently viewed as a model of economic stability and corporate excellence.

What the Swiss Market Index Represents

The Swiss Market Index tracks the performance of the 20 largest and most liquid companies listed on the SIX Swiss Exchange. These companies are selected based on market capitalisation and trading activity, ensuring the index reflects the most influential players in the Swiss equity market.

Because the SMI focuses on established, large-cap firms, it is often described as a blue-chip index. Its constituents include globally recognised names across sectors such as pharmaceuticals, consumer goods, financial services, and industrial manufacturing. Together, these companies account for a substantial share of Switzerland’s total stock market value, making the index a powerful snapshot of corporate Switzerland.

The index is weighted by free-float market capitalisation, meaning larger companies have a greater impact on its movements. As a result, shifts in the performance of heavyweight firms can significantly influence the overall direction of the index.

The SMI as a Mirror of Economic Stability

Switzerland is known for political neutrality, sound fiscal management, and a strong currency. These characteristics contribute to an environment where businesses can operate with long-term planning and relatively low systemic risk. The SMI reflects this stability through its historical performance, which has often been less volatile than many international indices during periods of global uncertainty.

When the SMI trends upward over extended periods, it typically signals confidence in corporate earnings, export demand, and innovation within key industries. Conversely, periods of decline or heightened volatility often coincide with global economic pressures rather than domestic instability. This distinction reinforces the idea that Switzerland’s economy, while deeply integrated into global trade, is underpinned by strong internal fundamentals.

Investors frequently interpret the index as a measure of how well Swiss companies are navigating both domestic conditions and international challenges.

Sector Composition and Economic Insight

One of the most revealing aspects of the SMI is its sector makeup. The index is heavily influenced by pharmaceuticals and healthcare, reflecting Switzerland’s role as a global leader in life sciences. These sectors tend to perform steadily even during economic slowdowns, as demand for healthcare products is less sensitive to economic cycles.

Consumer goods also play a major role, particularly through multinational companies with strong global brands. Their presence highlights Switzerland’s export-driven economy and its ability to generate revenue far beyond national borders. Financial services, including banking and insurance, further underline the country’s long-standing reputation as an international financial centre.

This sector balance explains why the SMI often demonstrates resilience. Defensive industries provide stability, while exposure to global markets offers growth potential. Together, they form an index that closely mirrors the strengths of the Swiss economy as a whole.

Global Exposure and International Influence

Although the SMI is a national index, its reach is undeniably global. Many of its constituent companies generate a large portion of their revenue outside Switzerland. As a result, the index responds not only to domestic economic indicators but also to global trends such as changes in consumer demand, currency movements, and international trade dynamics.

This international exposure makes the SMI relevant to investors worldwide. It is often compared with other major indices to assess relative economic strength and corporate performance. In times of global market stress, Swiss equities are sometimes viewed as a defensive asset class, which has increased interest in the index.

Understanding the SMI in a Broader Context

The SMI is frequently used as a benchmark for investment products and market analysis. Its performance influences portfolio strategies, pension fund allocations, and broader discussions about economic health. Because it represents a concentrated group of leading companies, it offers clarity rather than complexity, making it easier to interpret than broader indices with hundreds of constituents.

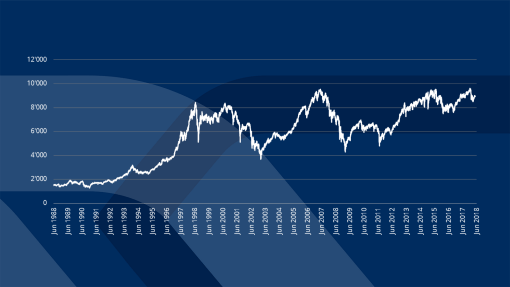

For those looking to explore Switzerland’s equity market more closely, following the SMI index provides valuable insight into how major Swiss companies are performing and how economic strength is reflected in market data. A closer look at the index and its movements can be found here: SMI Index.

This perspective helps bridge the gap between abstract economic concepts and real-world corporate performance.

Conclusion

The Swiss Market Index is far more than a daily market figure. It reflects Switzerland’s economic foundations, corporate strengths, and global connections. Through its composition, performance trends, and international relevance, the SMI offers a clear window into how economic strength is built and sustained in one of the world’s most stable economies.

By understanding what drives the index and how it responds to changing conditions, readers can gain a deeper appreciation of Switzerland’s market dynamics. Whether viewed from the perspective of an investor, an analyst, or a curious observer, the SMI stands as a powerful indicator of economic confidence and long-term resilience.